Aug 25, 2022

Prices are up, demand is good, shipping is a real problem: summarises prospects for the coming chilled season. The recovery of venison prices continues and venison companies have been sharing their spring season expectations with their suppliers. DINZ understands these are well up on last year, but with sea freight risks shortening the export window.

Robinson: "Prices are up on last year, We are confident this is the right strategy to rebuild venison returns.”

Silver Fern Farms general manager sales Peter Robinson says its chilled sales are well advanced for the period where New Zealand can take advantage of the premiums available for chilled supply.

“Prices are up on last year, which is a good start”, he says. “This is the rebuild of venison demand, we want to reduce our reliance on the European commodity trade, and new markets are going well, but it means investing in new markets for the long term, so we don’t go back to a boom bust. We are confident this is the right strategy to rebuild venison returns, this is how we best position ourselves to capture greater value as the market overcomes its current supply chain and inflationary pressures.”

Duncan NZ general manager marketing and operations Rob Kidd agrees. Demand for EU chilled, “has been firm,” he says.

Kidd: Demand for EU chilled “firm”.

“We had hoped prices would have recovered more over the past 12 months, however, the sentiment in Europe is one of caution as they face tougher times.”

Post-Covid growth in dining out and consumer spending has slowed in Europe, with consumers now reluctant to spend, Duncan NZ’s market intelligence suggests.

“This is due to inflated costs of commodities such as gas, energy and food, as a result of the conflict in Ukraine and looming global recession.”

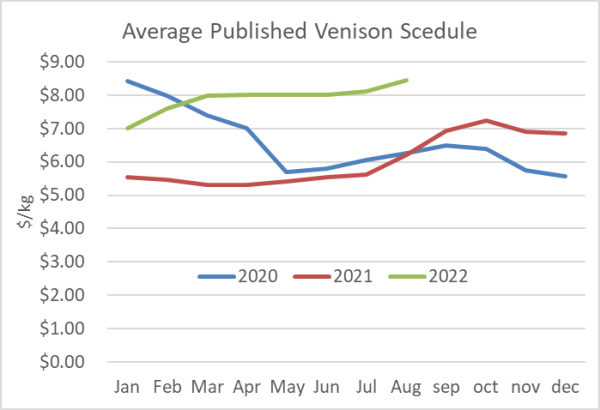

At the time of writing, published schedules for venison had lifted to between $8.25-$8.45/kg – 48-51 percent above the national average for July 2021 and were tracking just under two to four percent ahead of the five-year average for the month.

For the coming season, Silver Fern Farms and its in-market partners, “have identified shipping routes and specific shipping companies, which are delivering to schedule at an acceptable risk level, although the risk does exist,” he says.

For Kidd, airfreight to specific markets will “always be an option, but it will remain on a case-by-case basis,” he expects.

However, the continuing “exorbitant” airfreight prices are testing the viability of that alternative, for Robinson. Any volumes sent by air would probably not be at a premium over chilled, “as both the exporter and importer will need to absorb the cost to make the product affordable for the consumers,” he notes.

The continuing recovery in all markets – Europe, Asia and North America – is vital, says Kidd.

“We believe the foodservice sectors will continue on their recovery trajectory. Demand driven through this channel is the key.”